Transitional Adjustments when Entering or Leaving the Cash Basis for Self Assessment

Last modified:

If you are on Self Assessment for Income Tax and have moved either above or below the Cash Basis threshold, you will need to make a few adjustments within the software to allow for this. Before we look at the method, there are some general points to consider.

Income accounts are Credit accounts and Expense accounts are Debit accounts

To increase an income (Credit) account, you need to record a Credit to that account. To reduce it, record a Debit.

To increase an expense (Debit) account, you need to record a Debit to that account. To reduce it, record a credit.

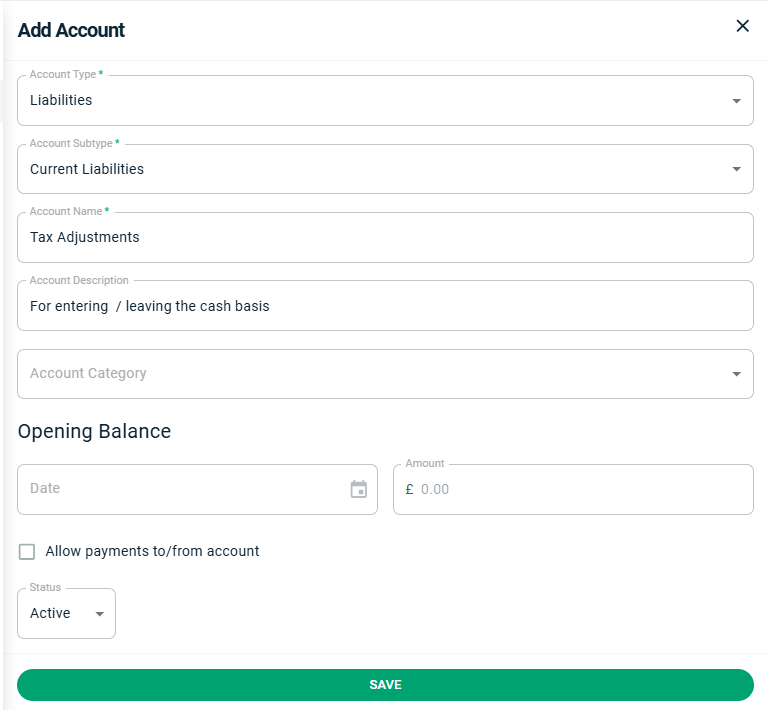

You will need to add a Liability account called Tax Adjustments. You can do this in Settings > Chart of Accounts > Add Account. The other options are Account Subtype: Current Liability and Category can remain blank.

Anything added to the income and expense accounts needs to have an opposite transaction in the Tax Adjustments account. There are potentially up to six journal entries to add and these are listed below.

When entering the cash basis the following Debit and Credit transactions will need to be recorded for each transitional adjustment, if any:

Receipts related to income in last tax year - reduce Income balance, therefore Debit Rental Income account and Credit Tax Adjustments

Payments related to expenses in last tax year - reduce Expense balance, therefore Credit General Expenses and Debit Tax Adjustments

Payments related to finance costs in last tax year - reduce Expense balance, therefore Credit Residential Finance Costs and Debit Tax Adjustments

Income received in advance in last tax year - increase Income balance, therefore Credit Rental Income account and Debit Tax Adjustments

Amount prepaid in last tax year - increase Expense balance, therefore Debit General Expenses and Credit Tax Adjustments

Finance costs prepaid in last tax year - increase Expense balance, therefore Debit Residential Finance Costs and Credit Tax Adjustments

When leaving the cash basis the opposite transactions need to be recorded for each transitional adjustment, if any:

Outstanding income in last tax year - increase Income balance, therefore Credit Rental Income account and Debit Tax Adjustments

Outstanding expenses in last tax year - increase Expense balance, therefore Debit General Expenses and Credit Tax Adjustments

Outstanding finance costs in last tax year - increase Expense balance, therefore Debit Residential Finance Costs and Credit Tax Adjustments

Income received in advance in last tax year - reduce Income balance, therefore Debit Rental Income account and Credit Tax Adjustments

Amount prepaid in last tax year - reduce Expense balance, therefore Credit General Expenses and Debit Tax Adjustments

Finance costs prepaid in last tax year - reduce Expense balance, therefore Credit Residential Finance Costs and Debit Tax Adjustments

You will need to work out the numbers yourself before entering them.