Recording Bad Debt

Last modified:

Your tenant has left, disappeared without trace and they still owe you money. It's an awful situation but you still have to record it. Here's how you do it in Landlord Vision.

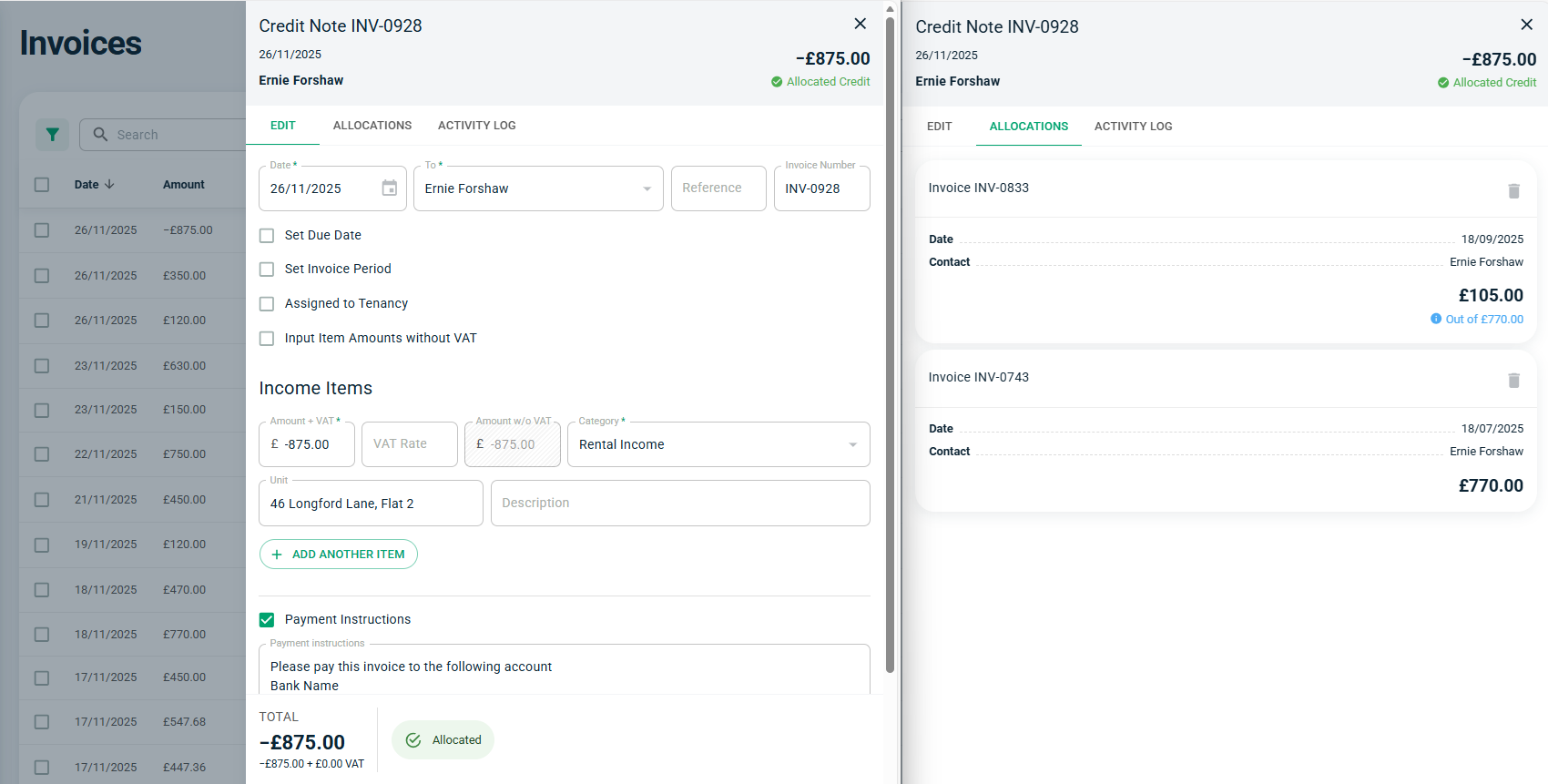

If there is just the one invoice to write off, open the invoice and select the Allocations tab. Press Add Credit Note. Enter the amount to write off as a negative number, set the invoice to the Bad Debt category and save it.

You can do this for multiple invoices too, but a quicker way is to raise a single negative invoice (credit note) for the full amount to be written off. Again, do this in Income > Invoices > Add Invoice. Set the amount you are writing off to be negative number and the Category to be Bad Debt. Once you have saved the credit note, you can then allocate it to as many unpaid invoices as you need to.

If you eventually recover the money then simply remove the credit from the rental invoice and record the payment to the rental invoice as you would have done if it had been a rental payment.

If there is just the one invoice to write off, open the invoice and select the Allocations tab. Press Add Credit Note. Enter the amount to write off as a negative number, set the invoice to the Bad Debt category and save it.

You can do this for multiple invoices too, but a quicker way is to raise a single negative invoice (credit note) for the full amount to be written off. Again, do this in Income > Invoices > Add Invoice. Set the amount you are writing off to be negative number and the Category to be Bad Debt. Once you have saved the credit note, you can then allocate it to as many unpaid invoices as you need to.

If you eventually recover the money then simply remove the credit from the rental invoice and record the payment to the rental invoice as you would have done if it had been a rental payment.