Recording Personal Drawings and Directors Loans

Last modified:

You've taken a sum of money out of your bank account and used it for personal reasons. Technically this is not a business expense so you can't claim for it but we still need to match it with the bank statement. The transactions are entered using the Journal. When adding entries to the journal, we credit the giver and debit the receiver. This guide goes through the most common scenarios.

Personal Expenses or Drawings

For personal expenses that are paid from the business bank account, or if you are moving money to your own personal bank account, you can use the Ignore option.

First set up an account such as Withdrawing Account or Owner / Director Current Account (both accounts are like Director's Personal Expenses)

Navigate to My Portfolio, you will find this located top left of your screen, use the drop down arrow and click the 3 dots > click Settings > Chart of Accounts > green + > Add Account > Set the Account Type to be Liability and complete the form as below. You only need to fill in the first three fields.

Now when you are reconciling, click the 3 dots to the right of the transaction > Ignore, then select the Liability account you made previously. The software will generate an entry in Banking > Journals.

The system will see these as transfers of cash and not expenses and will handle them differently. The transaction will be removed from the Reconcile tab and will appear on both the Bank Statements page and Account Transactions page as Ignored. The Account Balance will be updated accordingly so that you can continue to monitor this and compare it with your actual bank balance.

Director's Loans

Sometimes the owner of a business may deposit some their own money into it, for example as cashflow when the business starts, and then withdraws this amount at some point in the future, or the business may loan funds to the owner which the owner then pays back to the company. These transactions are recorded against a Director's Loan Account.Create a Director's Loan Account as a liability account in My Portfolio, you will find this located top left of your screen, use the drop down arrow and click the cog > click Chart of Accounts > green + > Add Account > complete all the fields > Tick Allow payments to/from account > Save

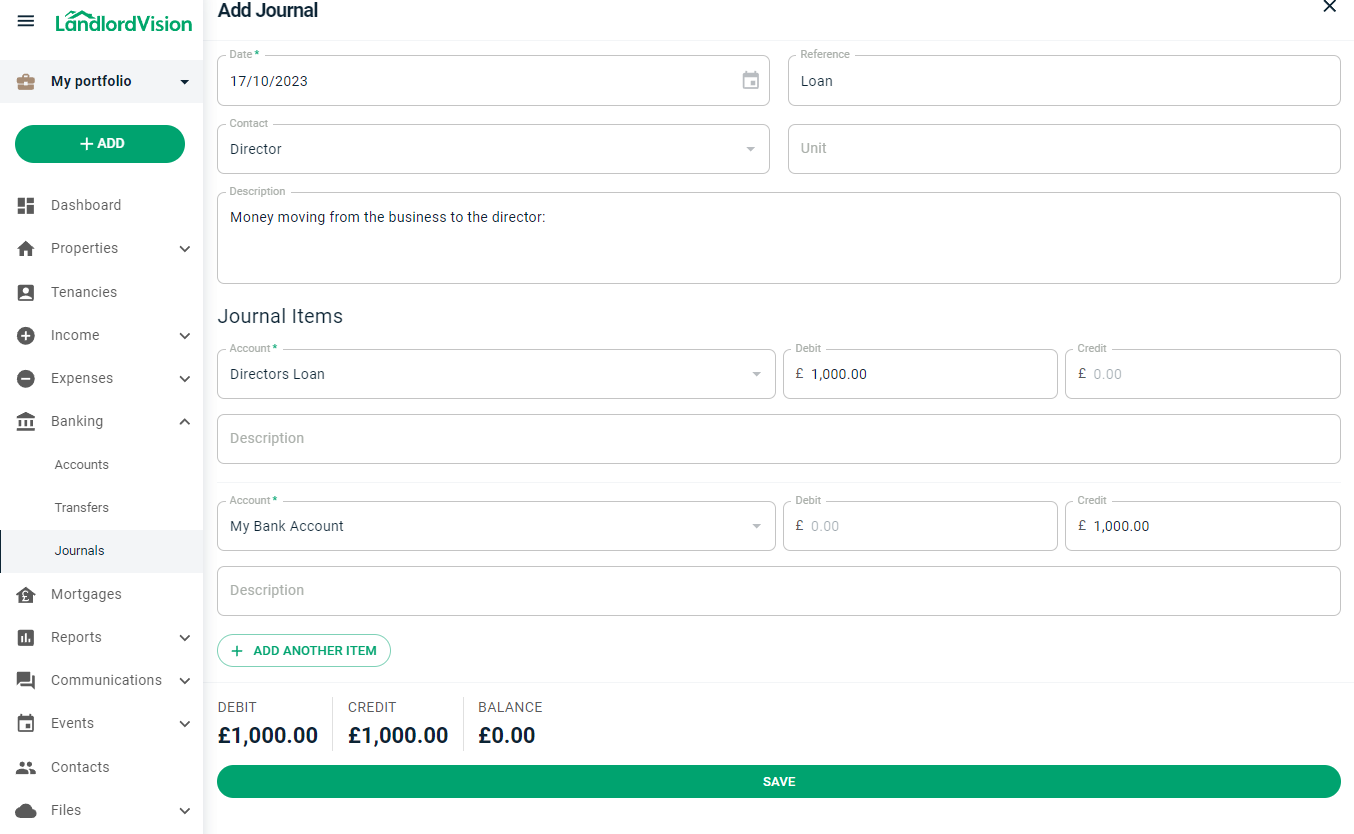

Under Banking > Journals > Add Journal, again, you don't need to select a Unit but do fill in the rest of the details. The example below is showing money moving from the business to the director:

If the director pays into the business as a loan, then you will need to reverse the above transactions.

*NOTE* Debit the receiver, and credit the giver is a golden rule for Personal A/c. By debit the receiver means the person who is receiving goods on credit will be debited and the person who is giving will be credited.

Both methods work for both scenarios, but we have covered each of them here.