Dealing with the deposit at the end of a tenancy

Last modified:

At the end of the tenancy, it becomes necessary to return the deposit back to the tenant. Or retain at least some of it for dilapidations. This guide covers the basic processes.

Notes: Custodian refers to the processes if a third party custodian has the deposit. Insurance based assumes that you have the deposit. Where it says bank account, the guide refers to the account that the deposit is paid from. If the deposit is moved from another account first, you will need to account for this as well, usually with a journal or a transfer.

1. Deposit returned

Custodian: In Banking > Transfers, record a transfer from Custodian Deposits to Tenant Deposits.

Insurance based: Raise a negative invoice for the amount being returned. IE, if you are returning £500, the invoice should be for -£500. Set the Category to be Tenant Deposits and mark as paid from the bank account.

2. Deposit retained to pay rent

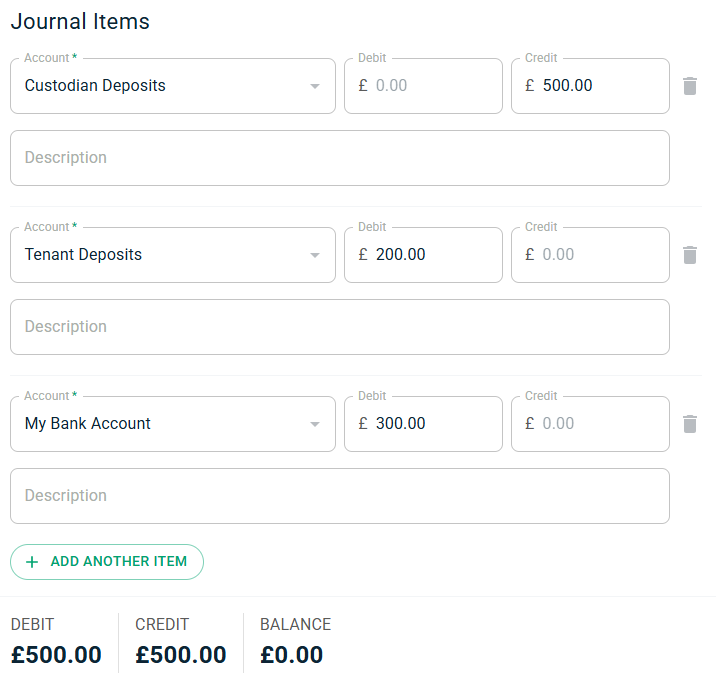

Custodian: There are two steps to this because there is a payment from the custodian to the bank account and that money needs to be used to cover the rental invoice. This process assumes a deposit for £500, of which £200 was returned and £300 was retained to cover a rental invoice.

Raise a journal in Banking > Journals showing the money coming from the Custodian Deposits account to the Tenant Deposits account and the bank account.

If all of the deposit was retained, simply record a transfer from the Custodian Deposits account to the bank account.

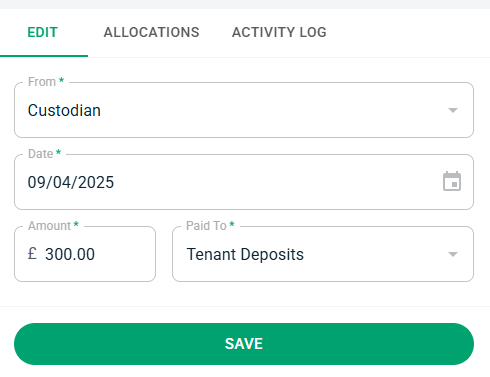

Then add a payment to the invoice but set it to the Tenant Deposits account.

Insurance Based: Record a payment against the invoice from the Tenant Deposits account (as above) but don't record the journal.

3. Deposit retained to pay charges

If some or all of the deposit was used to cover out of pocket expenses, you can record this too. The process is the same as that recorded in section 2 above, but rather that paying an existing rental invoice, you will need to add an invoice for the amount that you are charging the tenant and pay that instead.

Raise an invoice in Income > Invoices set to one of the Tenant Income (Non Rent) categories. Pay this from the Tenant Deposits account.

Raise a bill for the amount of money you spent. The category should be the one relevant to the work done and the payment account should be the bank account.

Then go through the process outlined in section 2 above.

We advise that you make notes in the diary sections at each update so that you have a complete record of what went on.