Recording A Property Purchase

Last modified:

You would like to record a property purchase in your Landlord Vision account. This is a guide to help you do just that. If you would like to record a property sale then please see - Recording a Property Sale

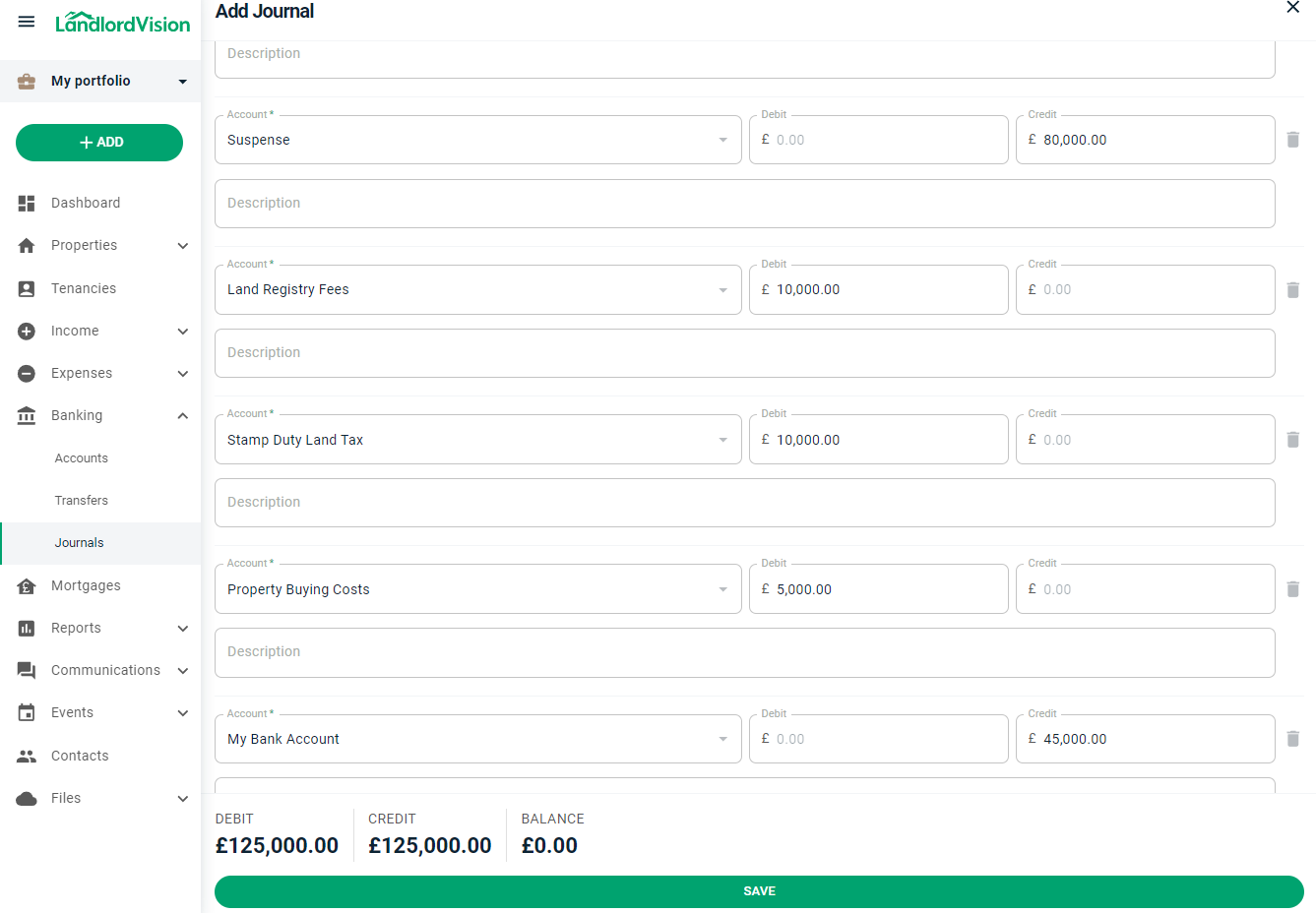

The recording of a property purchase in Landlord Vision is basically one big journal entry.

Navigate to Banking > Journals > click the green + to Add Journal

Account | Debit | Credit

Properties | Amount | 0.00 | This is the purchase price.

Suspense | 0.00 | Amount | This is the mortgage amount.

Click ADD ANOTHER ITEM

Add the different fees to their various account, they should be mostly asset accounts, for example.

Account | Debit | Credit

Land Registry Fees | Amount | 0.00

click ADD ANOTHER ITEM

| Debit | Credit

Stamp Duty Land Tax | Amount | 0.00

Click ADD ANOTHER ITEM

| Debit | Credit

Property Buying Costs | Amount | 0.00

Click ADD ANOTHER ITEM

| Debit | Credit

Bank Account | 0.00 | Amount | This is what came out of the bank account (deposit)

For example:

> SAVE At the end you should have one journal entry with six line Items

Lastly - Add the mortgage. See this Guide to - Add A Mortgage When adding the mortgage *Set Loan Paid To > Suspense account