Recording A Property Sale

Last modified:

You would like to record a property sale in your Landlord Vision account. These is a guide to help you do that. If you would like to record a property purchase then please see - Recording A Property Purchase

The recording of a property sale in Landlord Vision is basically one big journal entry.

Firstly - You need to enable the posting TO and FROM a few of the accounts you are going to be using.To do this - navigate to My Portfolio, you will find this located top left of your screen, use the drop down arrow and click the 3 dots > Settings.

This will open a screen very similar to this:

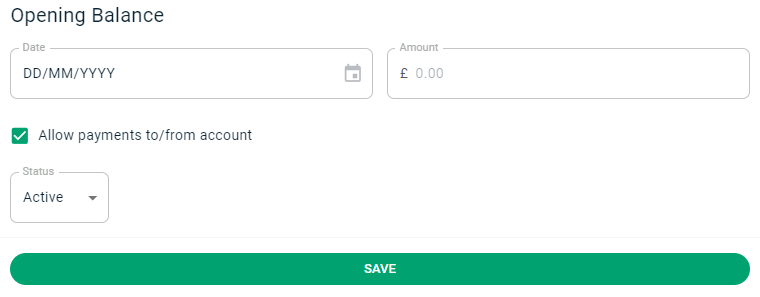

Click 'Chart of Accounts' > search for an account called 'Properties' > click on the 3 dots to the right of the account > Edit > tick 'Allow payments to/from account' > Save *See Screenshot below

Complete the same process for the following accounts if they haven't been set already:

Suspense

Property Selling Costs

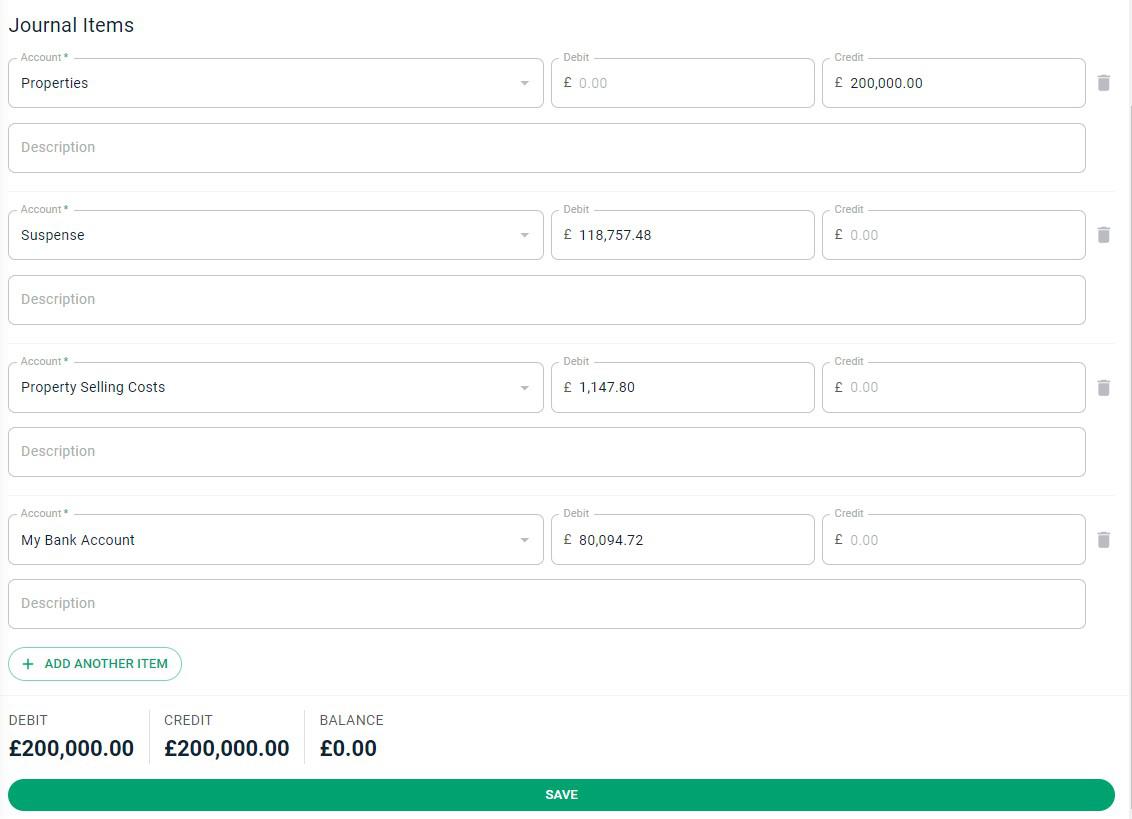

Secondly - You then need to record the journal entry:

Navigate to Banking > Journals > click the green + to Add Journal

Account | Debit | Credit

Properties | 0.00 | Amount |This is the sale price.

Suspense | Amount | 0.00 |This is the mortgage redemption amount.

Click ADD ANOTHER ITEM

| Debit | Credit

Property Selling Costs | Amount | 0.00 | Any additional fees associated with selling the property.

Click ADD ANOTHER ITEM

| Debit | Credit

Bank Account | Amount | 0.00 |This is what was paid into the bank account (equity)

For example:

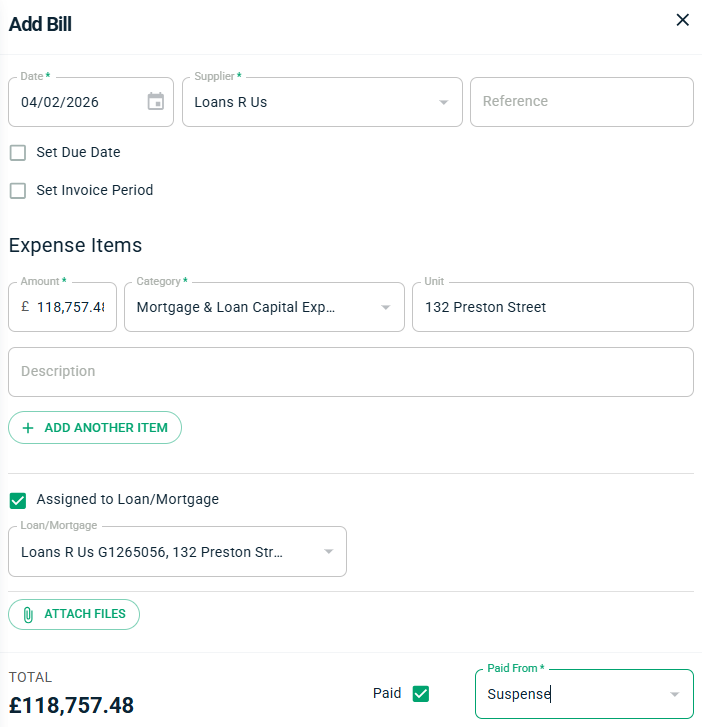

Lastly - Close the mortgage. This is a two part process:

Record a redemption payment. Go to Expenses > Bills (or the Payments option on the three dots menu on the Mortgages page) and add a bill. Set the Category to be Mortgage and Loan Capital Expense and set the Mortgage field at the bottom of the bill. Add a payment from the Suspense account.

Next, go to Mortgages > Edit Mortgage > Status > Closed.

*For capital gains, property purchase and sale amounts are entered in to the Properties account

Expenses related to the purchase and sale of a property are set to the Property Buying Costs and Property Selling Costs sub accounts. Other capital costs go to the Capital Costs account.