Recording Corporation Tax

Last modified:

First Create The Account

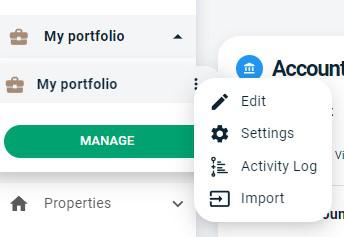

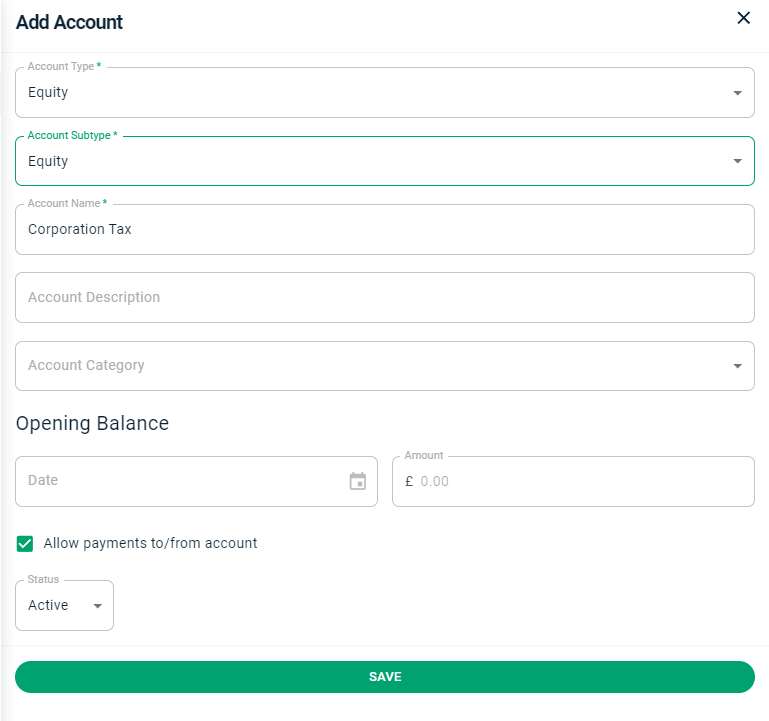

1 - Head to My Portfolio > 3 dots > Settings > Chart of Accounts > Add Account and add an Equity account with the name Corporation Tax > Save *Example below

Locating Chart Of Accounts:

Creating the Account:

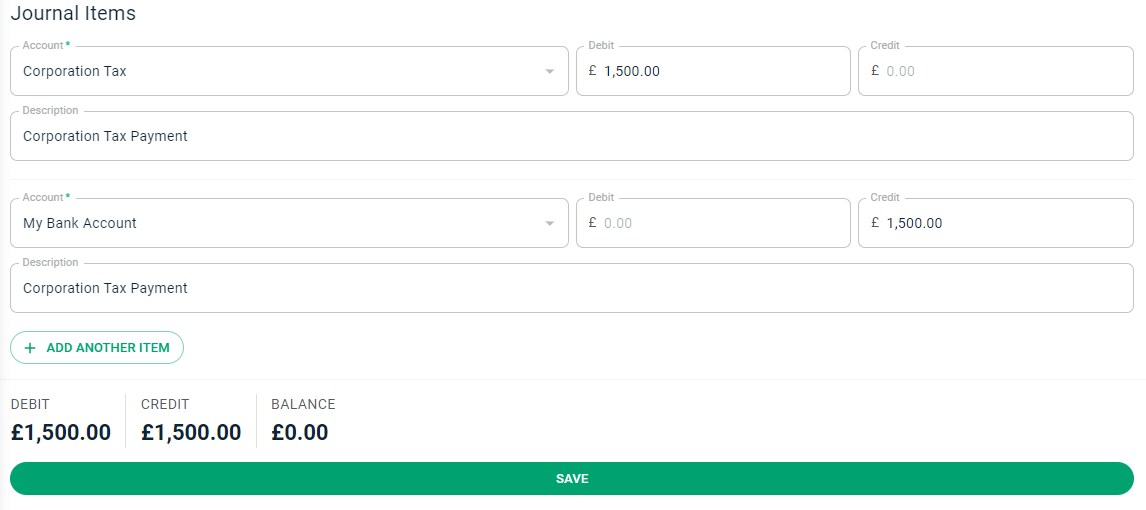

2 - Add The Journal

Head to Banking > Journals > Add Journal > Each corporation tax payment could be recorded using the following journal entries. In this example the payment is £1500. > SAVE

If you prefer to first record your corporation tax liability and then later record the corporation tax payment, you will need to do the following:

Firstly, create a liability account called Provision for Corporation Tax in the way outlined above, then post the following journal entries:

- When tax is calculated:

Debit Corporation Tax (Equity) <Corporation Tax Amount>

Credit Provision for Corporation Tax (Liability) <Corporation Tax Amount>

- And when tax is paid to HMRC:

Debit Provision for Corporation Tax (Liability) <Corporation Tax Amount>

Credit Business Bank Account <Corporation Tax Amount>